Mid-June highlights

- World durum wheat prices remained steady with few sellers in the market

- June Coceral report is out

- Sowings completed in North America with favourable conditions

- Concerns about new crop quality due to excessive rainfall in Italy, Greece and southern France

Durum wheat prices across the world

Durum wheat prices in Europe remained steady in the beginning of June yet market participants continue to buy hand to mouth as they await harvesting developments on the continent, still slowed by frequent rains in Italy, southern France and Greece.

In North America, durum wheat prices remained unchanged, and the market has few sellers, still cautious to offer on the new crop.

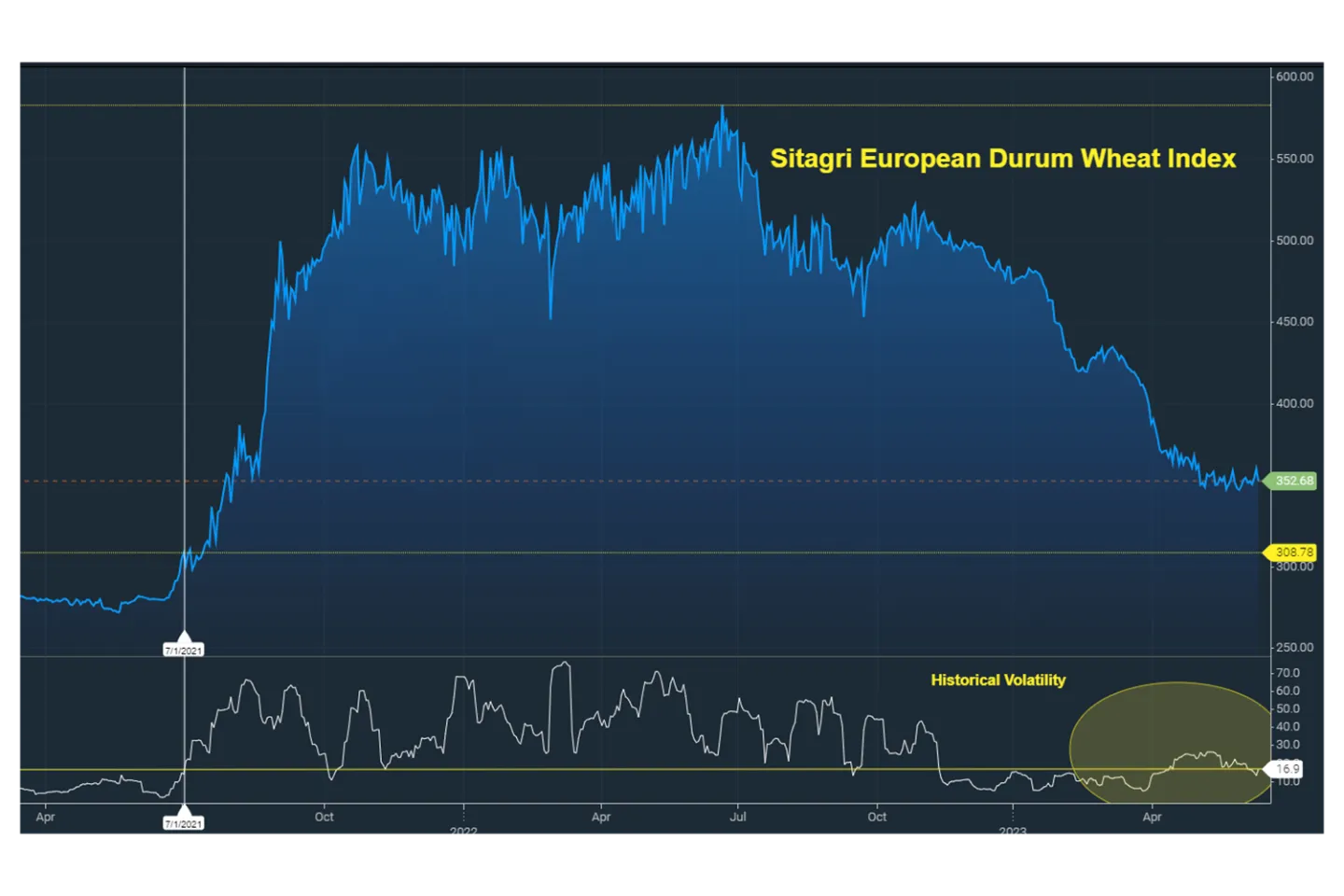

Price volatility in the SEDWI index has fallen sharply to the 15-point level, as shown in the chart below, returning close to 2020-2021 crop year levels, just as prices themselves in Europe may also be trending back to 2020-2021 crop year levels due to the likely low quality of the new crop.

US durum ending stocks for the 22-23 marketing year are estimated by the USDA at 24 million bushels or about 650,000 MT, at the lowest levels in 10 years. In Canada, 300 to 500,000 MT are forecast also at minimum levels in the past 10 years.

In contrast, the world market outlook for soft wheat seems divergent from that for durum wheat. In fact, large ending stocks from the 2022-2023 marketing year in Russia, the Black Sea countries and the EU will keep the market well supplied ahead of the new crop, which already has excellent production potential.

In summary, decorrelation between durum wheat prices and soft wheat prices seems likely due to completely divergent S&D fundamentals.

The spread between CWAD No. 1 and Canadian soft wheat CWRS No. 1 prices for the new 2023 crop for September 2023 delivery has narrowed in recent weeks, reaching 0.34 CAD/bu, equivalent to about 9 USD/MT. At Canadian primary elevators for September '23 delivery, CWAD No.1 quotes 9.53 CAD/bu equivalent to 262 USD/MT and CWRS quotes 9.19 CAD/bu equivalent to 253 USD/MT.

In Canada, spot old crop prices for July-August 2023 delivery at origin were unchanged on week 23 at 10.69 CAD/bu - (departure primary elevator in Saskatchewan) corresponding to today's CAD/USD exchange rate at about 294 USD/MT, to which the basis value of about 60-65 USD/MT must be added to get the FOB Vancouver price, equivalent to today at about 355 USD/MT. Considering a Panamax vessel freight rate from Vancouver to a Mediterranean port, for shipment in June, of about 30 USD/MT we reach a C&F basis price equivalent to about 385 USD/MT.

In Canada, prices for the new crop 2023 for delivery September 2023 (primary elevator departure in Saskatchewan) are quoted today at 9.53 CAD/bu corresponding to today's CAD/USD exchange rate at about 262 USD/MT, to which we need to add the basis value estimated today at about 65-70 USD/MT to get the FOB St. Lawrence price, today equivalent to about 330 USD/MT. We estimate the charter value of a Handymax from St. Lawrence to Italy at about 30-35 USD/MT, yielding a Mediterranean CIF price of 370-375 USD/MT. From Vancouver Mediterranean CIF price for Panamax vessels for shipment Sept-Oct 2023 is equal to 360-365 USD/MT.

In Italy, old crop durum wheat offers are now nearly exhausted due to farmers' retention of the few remaining available lots that are carried over to the new crop for blending.

Source: Sitagri

Focus on durum wheat prices in Italy

In Puglia, Italy, new crop durum wheat prices for delivery from July 2023 are indicatively quoted at €320-€325/MT delivered to mill. In Central Italy the market is not yet formed due to the continuous rains and does not yet show any trade, while in Sicily durum is traded at about €310/MT delivered to mill for standard quality, although the local market remains very difficult to interpret due to the constant rains expected until the end of mid-June with potential further quality damage.

In our opinion the potential for any further decline in durum wheat prices, in Italy and the rest of Europe, should not exceed 10-15% of current value despite potential quality problems.

Durum mills in Italy remained very cautious in communicating new semolina prices while waiting to assess the quality of the new crop. Nominal prices for standard quality durum wheat semolina per delivery in the June-December 2023 period remained unchanged in the area of €440-€445/MT per delivery in Northern Italy, €435-€440/MT in Puglia and Central Southern Italy.

Crop vegetative conditions in Italy are deteriorating due to constant rains in most Italian regions, particularly in Latium, Marche, Sicily and Apulia. Concerns about quality and yields of the new crop are increasing.

In Sicily, early harvesting shows wheat with test weight and protein below standard levels.

In Puglia, harvesting has begun in the Tavoliere in the province of Foggia. The first cuts show very heterogeneous quality with test weight ranging between 80 and 72 kg/hl and protein content is regular between 12 and 13%. However, harvesting operations are expected to start in full swing from 20 June 2023 due to the expected entry of high pressure in Italy starting the second part of June.

Canadian durum wheat exports

In Canada and the US, durum wheat conditions are good and almost all sowings have been completed with wheat already emerged as of 13 June.

Agriculture Canada released its May budgets. For durum wheat, it increased the acres sown by 388,000 acres compared to April to 6.06 million acres. This brought production to 5.82 MMT (5.44 MMT previously) and total supply to 6.3 MMT (5.97 MMT previously). The AAFC also increased its 2023/2024 export forecast by 350,000 MT to 4.75 MMT. The increase in projected exports means that the 2023/2024 ending stocks remain relatively limited at 600,000 and 800,000 MT.

Total shipments (actual exports) of Canadian durum wheat from the time of harvesting - late August 22 to present (44 weeks) - have reached about 4,600,000 MT. Agriculture Canada expects durum wheat exports for 2022/2023 to reach 4.8 MMT, which would leave only 300,000 MT to be shipped in the next 8 weeks, maintaining an average pace of 28,000 MT per week.

According to StatsCan data, Canadian durum wheat exports in April were good, reaching 567,100 MT, for a seasonal total of 4.2 MMT. Algeria was the main buyer in April, importing 215,5000 MT during the month. Algeria imported a total of 527,700 MT from August to April, two and a half times more than last year. Italy remains the top customer of Canadian durum. The country imported 83,000 tons in April, a seasonal total of 1.2 MMT, compared to 223,000 tons imported at this time last year.

Coceral’s June report

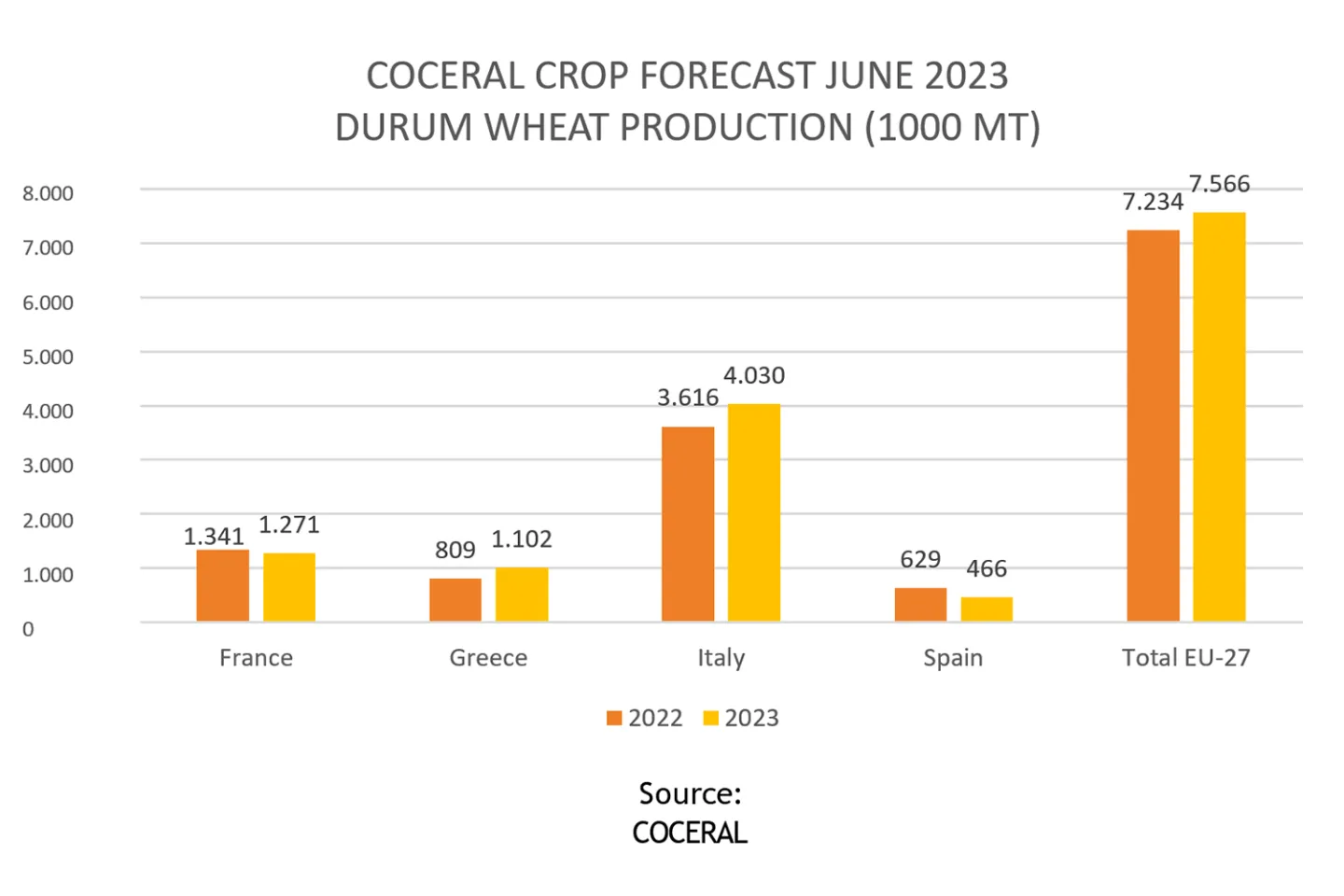

Coceral, the European association, for the grain and oilseeds trade, has released its June crop report. The 2023 European durum wheat crop is still seen upward at 7.5 MMT from last year's production of 7.2 MMT and despite declines in production in Spain and France, offset by Italy and Greece.

According to some analysts, in Spain, the prolonged drought has had a devastating impact on the country's durum wheat crop, with some forecasting as low as 250,000 and 350,000 MT.

According to the Kazakh Ministry of Agriculture, Kazakhstan is forecasting a 2023 crop of durum and soft wheat of 16 MMT. The 2022 crop was 16.4 MMT so there may be a 2.4% drop in production in the coming marketing year.

World durum wheat production 2022-2023 vs 2023-2024 estimates

Article provided by Intergrain in partnership with FinanceAgri

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at https://www.euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.