Risk of inflation

Inflation has a negative effect on a bond’s return. If inflation is high, revenues received from a fixed rate issue and the repayment of the nominal value at maturity risk depreciation over time. So, it is important to think in terms of the real interest rate. This is a simple way of calculating the real interest rate:

Real interest rate = Nominal interest rate – Inflation rate

To manage the risk of inflation, it is possible to invest in bonds such as OATis (fixed-rate bonds indexed on inflation),

issued by the French government. Their principal is indexed on a daily reference rate related to the French

consumer price index. So, coupons follow the general price level, as does the nominal value at maturity.

Interest rate risk

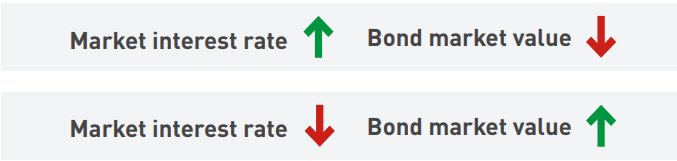

The value of a fixed rate bond is not stable over time and depends on general interest rates. When market interest rates increase, new investment opportunities arise at more competitive rates. The value of the bond will subsequently decrease, so the bond yield levels with that of new issues. Inversely, when the market interest rates decrease, the value of fixed-rate bonds increases.

In adverse market conditions, the loss of capital on the amount invested will only occur in the case of a transfer of securities. When an investor holds fixed-rate bonds to maturity, the return offered by the investment is equal to the yield to maturity. One way of managing interest rate risk is to invest in variable coupon rate bonds.

Credit risk

Credit or default risk is when an issuer finds himself unable to pay interest and/or the capital at maturity. It is difficult for investors to evaluate this kind of risk, so specialised businesses and rating agencies publish lists to give an insight into the capacity of issuers to meet their obligations.

For mid to long term operations, S&P (Standard & Poor’s) and Fitch ratings run from AAA to C, and Moody’s from Aaa to C. The higher the rating (i.e., the closer to AAA) the lower the credit risk. Bonds with BBB ratings or above are known as Investment Grade bonds. Bonds rated lower than this are known as Speculative Grade investments. Below is a table showing the ratings used by Standard & Poor’s, Moody’s, and Fitch*:

| STANDARD & POOR’S | MOODY’S | FITCH | ||

|---|---|---|---|---|

| AAA | Aaa | AAA | Investment Grade Issuers with low default risk | |

| AA | Aa | AA | ||

| A | A | A | ||

| BBB | Bbb | BBB | ||

| BB | Bb | BB | Speculative Grade Issuers with high default risk | |

| B | B | B | ||

| CCC | Ccc | CCC | ||

| CC | Cc | CC | ||

| C | C | C |

The rating given to a bond issue may differ from that given to an issuer for a number of reasons including bond type and external guarantees, etc.

An issuer’s rating is not stable over time and can vary if its economic and financial situation worsens. The interest rate paid by a bond will be higher or lower according to the issuer’s creditworthiness. The lower the rating, the higher the interest rate offered will be. Similarly, change in rating during the life of a bond, will influence the premium/discount that the bond is traded at in the market.

Liquidity risk

On a financial market, the liquidity of an asset is the ability of an investor to buy or sell that asset without having to pay a premium or discount their price due to large numbers of investors. When you invest in bonds, you are not guaranteed to be able to resell your securities in favourable conditions.

To remedy this, some issuers with bonds listed on Euronext enter into Market Making Agreements with one or a number of financial institutions. These institutions commit to continuously offer buying and/or selling prices to ensure daily liquidity of the bonds on the regulated market.