On live.euronext.com, investors can find all the characteristics of the bonds admitted to negotiation. Below you can learn the steps to retrieve the information from our website.

In our example we will look for a CREDIT AGRICOLE S.A. loan to private individuals issued on 22 December 2016 for an amount of €469 million.

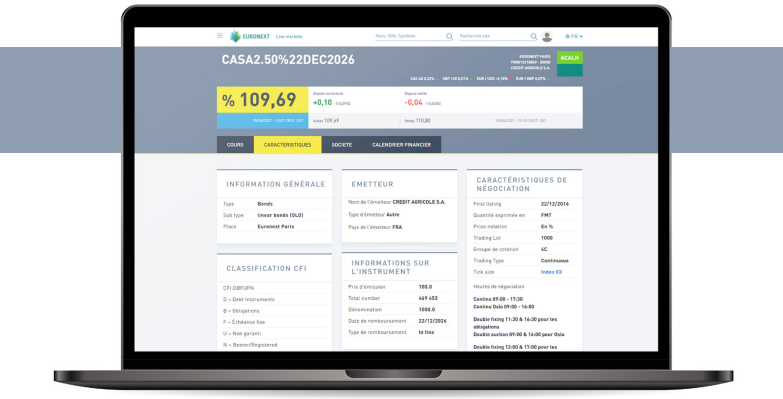

To find this bond, click on the search field at the top of the screen and enter the name of the issuer (CREDIT AGRICOLE S.A.) or the ISIN code (FR0013218849). After clicking on the security of their choice, investors can find the following information under the Characteristics tab.

Essential details provided include:

- ISIN code (in this case, FR0013218849), which identifies the financial instrument so it can be easily located on our site using the search facility on the home page.

- Issuer name.

- The rating allows you to check the issuer’s credit rating. However, some issued bonds can benefit from a different rating compared to the one of their issuers. For CREDIT AGRICOLE S.A., the bond prospectus indicates that the issuance has not been subject to a rating request.

- The issue price corresponds to the initial subscription price. In the case of CREDIT AGRICOLE S.A., the issuance was at par, i.e., at the nominal value (100%). An investor looking to buy bonds must pay 100%*1000=1000 Euro.

- The nominal rate allows the investor to predict the coupon they will receive periodically. Here it is a fixed rate bond of 2.5% with a coupon of 2.5%/4 x 1000, meaning €6.25 every three months or €25 annually. Calculating the coupon involves the nominal value, interest type and coupon frequency.