There are many different types of bonds that allow investors to develop a portfolio that suits their needs. The redemption/risk profile of a security depends on the issuer type.

Types of issuers

Bonds are often categorised according to their issuer type. There are supranational organisations, governments, state-owned businesses, private businesses, and semi-public businesses. These classifications give an initial indication of the creditworthiness of the issuer.

Government bonds

Governments enjoy a relatively high credit rating. The French government issues longterm bonds called OATs (Obligations Assimilables du Trésor). Other governments such as the Netherlands, Portugal, Belgium, Norway, Italy, Ireland, Austria, and Argentina also issue bonds which are listed on Euronext.

Corporate bonds

Businesses can use the market for medium to long term finance by issuing bonds. Business bonds generally offer returns that are higher than government-issued bonds. Some financial instruments issued by public entities or businesses in good financial health benefit from a higher rating. Businesses also issue high yield bonds with a higher risk of default. These businesses may be in financial difficulty with a downgraded rating, young businesses, or businesses undergoing an LBO*. These riskier bonds require comprehensive financial knowledge. Between these two extremes, there are many different yields and issuers, so investors can locate opportunities that suit their risk profile.

Bond Yields

Different to the nominal rate listed in the bond prospectus, the yield to maturity gives investors a better idea of the return on their investment. The definition of the yield to maturity, which may appear quite complex, uses a central concept in finance - that of time value of money. This discounting concept allows time to be taken into account when evaluating an asset.

€1 today will be worth, taking investment return rate t of one year into account, €1 x(1+r) in one year (discounting principle). On the other hand, if I am certain of receiving €1 in one year, the equivalent amount to this sum is worth €1 /(1+r) today. In finance, the current value of an asset is the discounted sum of the future cash flows it will generate over time. If the market value of a security is lower than its present value, it indicates that the investor expects the security to return more than their initial investment.

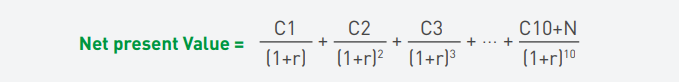

In an example, a bond with nominal N and a 10-year maturity. We call C1 the coupon paid the first year, C2, that paid in the second year, C3 in the third year and r is the required rate of return. The net present value of the bond is:

The bond yield rate is the rate at which the amount invested (the issue or purchase price) levels with the current value of the bond’s future cash flow.