Weather patterns and geopolitical factors continue to be the main drivers shaping volatility and price dynamics in grain and oilseed markets. Despite a bearish trend throughout the second quarter, prices became tense in June, with a dynamic weather market, due to adverse climate conditions impacting the coming harvest across the northern hemisphere and seeding in the south. Additionally, the Black Sea situation and the closure of the Black Sea grain corridor increase the uncertainties for the new campaign.

Last week, we reached another high stress point, and the Euronext MATIF commodity markets continued to offer the users safe and liquid hedging tools. 20 July in fact marked the all-time daily volume record on our Milling Wheat Futures with 187,898 lots traded, equivalent to 9.4 million tonnes of physical products.

During Q2-2023, prices on Euronext commodities contracts remained bearish, with an average price of €238/T vs €393/T in Q2-2022 for Wheat Futures, €435/T vs €834/T in Q2-2022 for Rapeseed Futures and €240/T vs €338/T in Q2-2022 for Corn Futures.

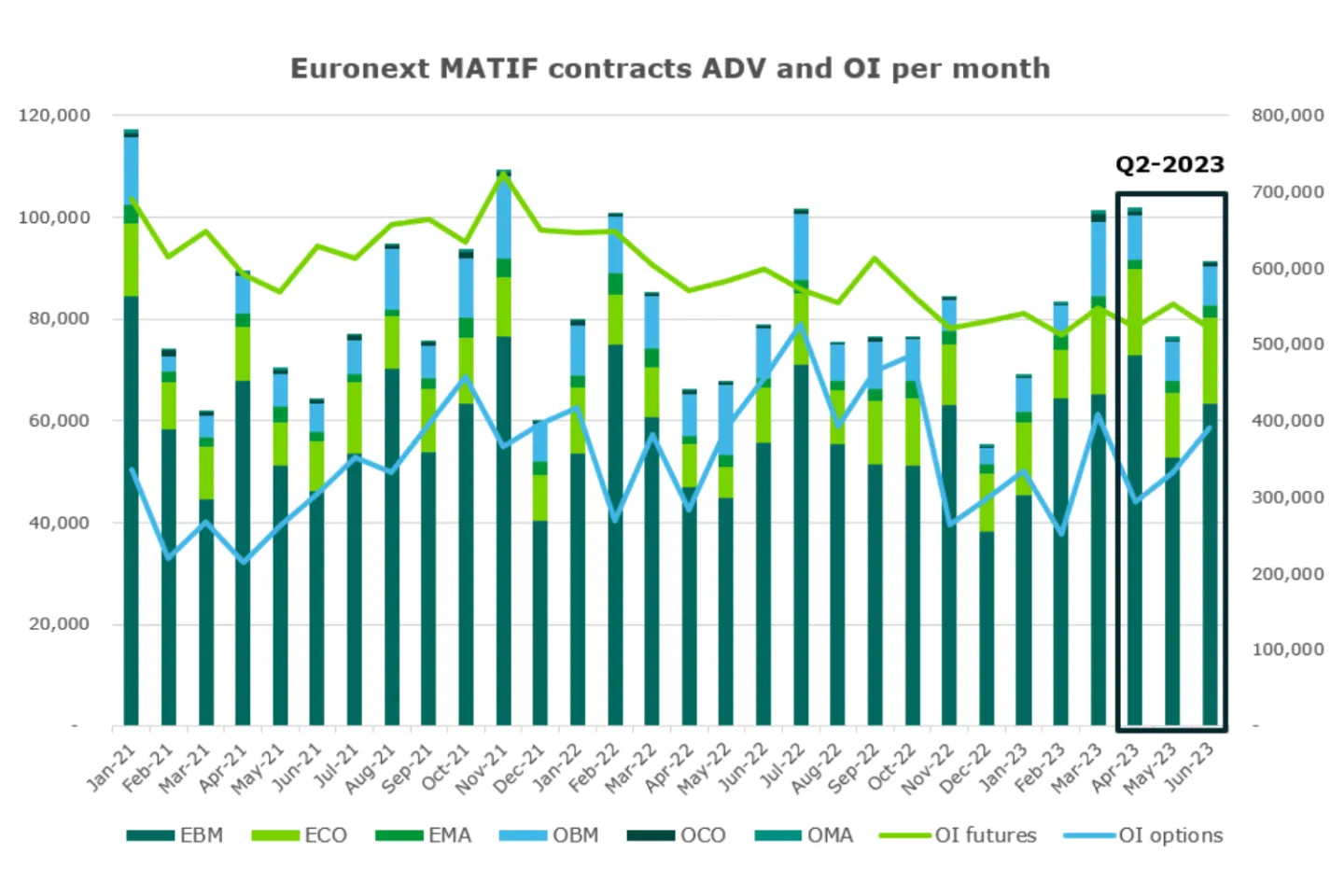

Volumes were up by +23% vs Q2-2022, led by Rapeseed Futures (+81% vs Q2-22) and Wheat Futures (+25% vs Q2-2022).

Average daily volumes were at 89K lots per day, including 62K lots of Wheat Futures, 2K lots of Corn Futures, 15.5K lots of Rapeseed Futures, 8K of Wheat Options and 1.2K lots of Corn and Rapeseed Options.

The Euronext Commodities team

Corn consultation

We are running a market consultation about the Corn Futures contract to further its traction and expand the current liquidity. Feel free to contact us at commodities@euronext.com to share your input/opinion on this product.

Euronext Clearing migration

Following the communication made back in 2022, the Euronext Group has initiated a large reorganisation of its post-trade services with the deployment of its newly acquired clearing house, Euronext Clearing on all Euronext segments.

At this stage, the project is on track: a first milestone with the migration of the cash equity segment by Q4-2023 will be followed by the Euronext MATIF migration in June 2024.

Trading fees waiver for commodity options executed in the Central Order Book

The average daily volumes traded in commodity options on Euronext have increased by 120% since 2018, exceeding 10K lots per day in 2023, an important milestone. This growth has resulted from a strong interest from market participants and confirms the importance of the Euronext MATIF franchise as an efficient tool for price risk management in highly volatile markets.

To accelerate liquidity building in the commodity options markets, we introduced as of 1 July 2023 a trading fee holiday for options executed in the Central Order Book.

| Options Central Order Book Trades | Trading fees |

|---|---|

| Milling Wheat, Corn, Rapeseed | €0 per lot |

| Milling Wheat, Corn, Rapeseed - strategies legs | €0 per let |

Introduction of a liquidity provision programme for options

To further boost the liquidity in the Central Order Book, we introduced a liquidity provision programme at the same time as the trading fees holiday programme.

- Submission of bids and offers on the screen every day for 80% of the time that the Euronext market is open (between 10:45 CET and 18:30 CET).

- Quoting the three first maturities with minimum quote size of 10 lots.

- Spread between bids and offers for the same month and the same strike to be within a range of 15 ticks.

- Minimum number of strikes required for a given trading day is calculated as 20% of the number of strikes available within the Near-The-Money area.

- Top performer (highest volume during a given month) will be granted a stipend.

New on the Euronext website

We publish every Monday the weekly average of the Sitagri European Durum Wheat Index (SEDWI) provided by FinanceAgri for the calculation of the EDW Futures EDSP.

View the weekly average of the index

Two new Commodities Insights articles were released. Read the articles on:

The Durum Wheat market

Black Sea Grains

We also released a second version of the Commitments of Traders (COT) report, in addition to the mandatory one. It includes historical graphs, making it easier to read and understand.

Access the additional COT report

The Commodities team at events

During Q2-2023, we were pleased to take part in several events such as the Bourse de Sète, Euro Grain Hub Exchange & Forum in Bucharest, GrainCom in Geneva, the International Grains Conference and FIA IDX in London, and the Bourse Internationale de Paris.

These events are an opportunity for us to meet all the European agricultural industry.

Find out more

See all our MATIF Commodities contracts on the Euronext Live Markets website.

Contact our team: commodities@euronext.com