Euronext is committed to ensuring transparency and integrity in financial markets. Recently, we have noticed an increase in fake profiles using our name to lure investors, promising easy gains or offering trading services via social networks.

What you need to know:

- Euronext never provides personal investment advice. You should always make investment decisions independently or with the assistance of certified financial advisors.

- Euronext does not offer trading services or advertise financial products on social media. Any profile doing so is unauthorised and not affiliated with the Exchange.

- Be cautious of promises of high easy returns. These messages are often traps set by scammers to steal money or sensitive data.

How to protect yourself from fake profiles:

- Always verify the source of the information. Our official content is published exclusively on our company website euronext.com and live markets website live.euronext.com, or on our verified LinkedIn account.

- Never share personal or banking information with strangers.

- Report any suspicious profiles to the appropriate authorities or the social media platform immediately.

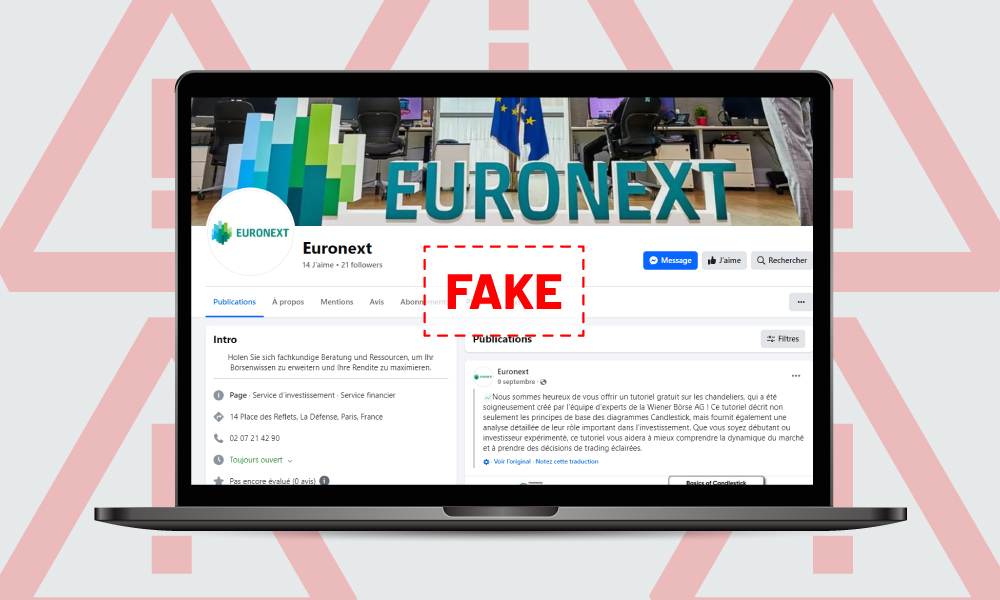

Examples of fake profiles

Here are some examples of profiles impersonating Euronext:

Financial education is your best defence

Financial education is crucial when investing in financial markets, as it equips individuals with the knowledge needed to make informed and strategic decisions. Understanding key concepts such as risk, diversification, and market dynamics can help investors avoid costly mistakes and maximise returns. Without this foundation, individuals may be swayed by emotions or misleading trends, leading to impulsive decisions and potential losses. Financial education also teaches investors to analyse assets, understand financial statements, and evaluate the suitability of different investment vehicles based on their risk tolerance, time horizon, and financial goals.

Moreover, a strong grasp of financial markets fosters discipline and a long-term perspective, both of which are vital for successful investing. Educated investors are better prepared to navigate market volatility and economic downturns, recognising them as opportunities rather than crises. Additionally, financial literacy enables individuals to assess the credibility of financial advisors, avoid scams, and understand regulatory frameworks that protect investors. By mastering these skills, investors can not only build personal wealth but also contribute to the efficiency and stability of financial markets, reinforcing their role in driving economic growth.

Remember: no reputable institution will ever ask for money or personal data through private messages on social media.

Links to Euronext

For financial education and market information from Euronext, visit live.euronext.com

Only follow our official channels!

- X x.com/euronext

- LinkedIn LinkedIn.com/company/euronext

- Euronext Live Markets live.euronext.com

- Euronext company website euronext.com