Introduction

Scope’s Mutual Fund Rating is an established method of evaluating the management quality of open-end funds and how this contributes to outperformance and risk minimisation compared to peers. A qualitative rating, which requires in-depth insight into the work processes of the investment company, is only provided if we receive a mandate from the respective investment company .

Methodology

The Scope fund rating always consists of a performance and a risk indicator, which represent the weighted sum of other sub-indicators.

In the case of young funds with a history of less than six months, the indicators are initially only evaluated qualitatively using a list of criteria. The Scope fund rating is a relative rating, i.e. the fund is always assessed by comparing it to a predefined peergroup. A peergroup consists of at least 20 comparable funds selected by Scope analysts.

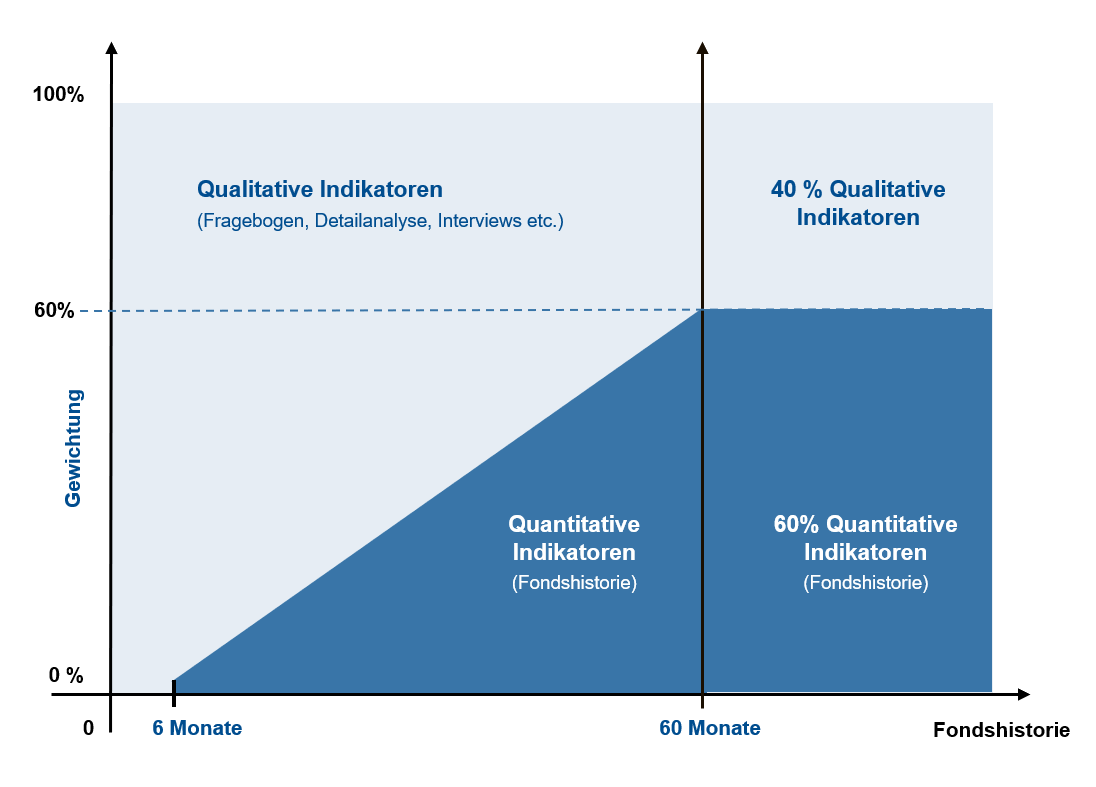

A qualitative assessment is performed once a year. If the fund has a track record of six months or more, the qualitative evaluation criteria are replaced linearly over time by a sytem of quantitative metrics -with up to 40% of the qualitative criteria replaced after 60 months. For funds with a history of over 60 months, the quantitative share is constant at 60%, while qualitative criteria make up 40% of our assessment.

Figure: Graphical representation of our qualitative rating methodology when mandated by the investment company.

If there is no mandate from the respective investment company, Scope will, without consultation with the company, provide a purely quantitative rating for funds with a history of at least 60 months.

The rating process

The assessment of a fund’s quality is based on a multi-dimensional model that uses both performance and risk indicators. The performance indicator has a 70 per cent weighting and comprises relative performance, long-term earning power and the stability of performance. The risk indicator (30 per cent weighting) assesses the timing risk, loss risk and behavioural risk of the fund. There are interdependencies between performance and risk indicators in both quantitative and qualitative valuations. High outperformance is usually accompanied by a high tracking error. However, this in turn has a negative effect on behavioural risk. In general, the more active a manager is, the weaker its behavioural risk assessment is.

| Performance contribution | Risk minimisation |

|---|---|

|

|

Figure: Assessment categories

Rating classes

Following a summary of the criteria for the individual components and the overall evaluation of the funds, the score is allocated to one of the five rating classes, ranging from A (very good) to E (poor). For each criterion, the fund is assigned a score of 1-100 relative to its competitors (in the same peergroup). If a specific indicator for a fund is in line with the median for its segment, it scores 50 for this indicator. The total score of relevance for the rating comprises the weighted score for the individual criteria.

If there is a major change in the fund management team, the fund rating will be flagged “ur” for “under review”.

| Rating | Points | Assessment |

|---|---|---|

| A | 100-78 | Very good |

| B | 77-60 | Good |

| C | 59-41 | Average |

| D | 40-23 | Below average |

| E | 22-1 | Weak |

A highly rated fund, i.e. at A or B, is expected to achieve a stable, above-average performance with relatively low risk in the medium term.

The complete Scope fund rating methodology is available here.