When the MV Razoni set sail from Odesa with 27,000 mt of corn on 1 August 2022, Ukraine's farmers hailed the reopening of their main export route. Now, with Russia's refusal to renew the Black Sea grain deal, they must rely again on trains, trucks and barges, which initially provided an emergency outlet immediately after Russia's invasion.

The immediate reaction to Russia's statement on 17 July was a surge in wheat and corn futures, with France's MATIF wheat contract trading at Eur237/mt by 11:00 GMT, having closed at Eur232/mt on 15 July, but that price move belied the pragmatic response of Ukrainian grain traders. Ukraine's exporters have been shifting their focus from the Black Sea to the Danube since April as Russia's intentions became clear.

The greater shock to Black Sea grain traders on 17 July resulted from the overnight attack on the bridge across the Kerch Strait, which forced Russia to suspend many of its own grain loading operations.

"Many have lost their hope [in the grain corridor]," a grain broker said about the Ukrainian market. "One medium size crusher in Ukraine who was shipping a Handysize to China via the corridor got a $1 million demurrage and detention bill," the broker added, referring to the costs that many exporters incurred due to time that their chartered ships spent waiting in the queue to enter the Black Sea ports.

The MV Razoni was the first ship to use the so-called grain corridor by which Russia and Ukraine agreed to provide safe passage through the Black Sea for ships carrying grain, foodstuffs and fertilisers. The revival of cross-border traffic by road, rail and river highlighted the shortcoming of the Black Sea Grain Initiative: exporters had to wait weeks for ships to be inspected, and there was a risk of Russia cancelling the agreement.

Not plain sailing

The agreement was signed by Russia, Turkey and Ukraine on 22 July 2022. It had a 120-day term that renewed automatically unless any signatory objected. Russia withdrew briefly prior to the expiry of the first term in November 2022 before renewing the agreement, but in March 2023 the country only gave its consent for a 60-day extension.

The last 60-day term expired on 17 July, with Russia's Ministry of Foreign Affairs citing a failure to reconnect its agricultural bank to the SWIFT system or restore access to its ammonia pipeline, among other issues. Russian President Vladimir Putin had earlier described the deal as "one-way traffic."

Even on 17 July, Putin's spokesman told reporters that Russia would return to the deal if its demands were met. But it's unlikely that Ukraine's grain traders would have confidence in any deal that relies on Russian goodwill. Meanwhile, Russia's wish to resume ammonia exports from the Ukrainian port Pivdennyi seems impossible after the Tolyatti-Odessa pipeline was damaged on 5 June.

One trader of Ukrainian grain, underlining the ways in which Russia had been limiting Ukraine's Black Sea exports without withdrawing from the agreement, said the Russians "find any excuse not to clear a vessel...If you read the huge registration conditions, it's always possible to find a typo or argue that a paper/certificate is missing."

"It's as though you're pledging your vessel as security on a loan and not just checking it for weapons," another trader said, referring to the documentation and inspections process.

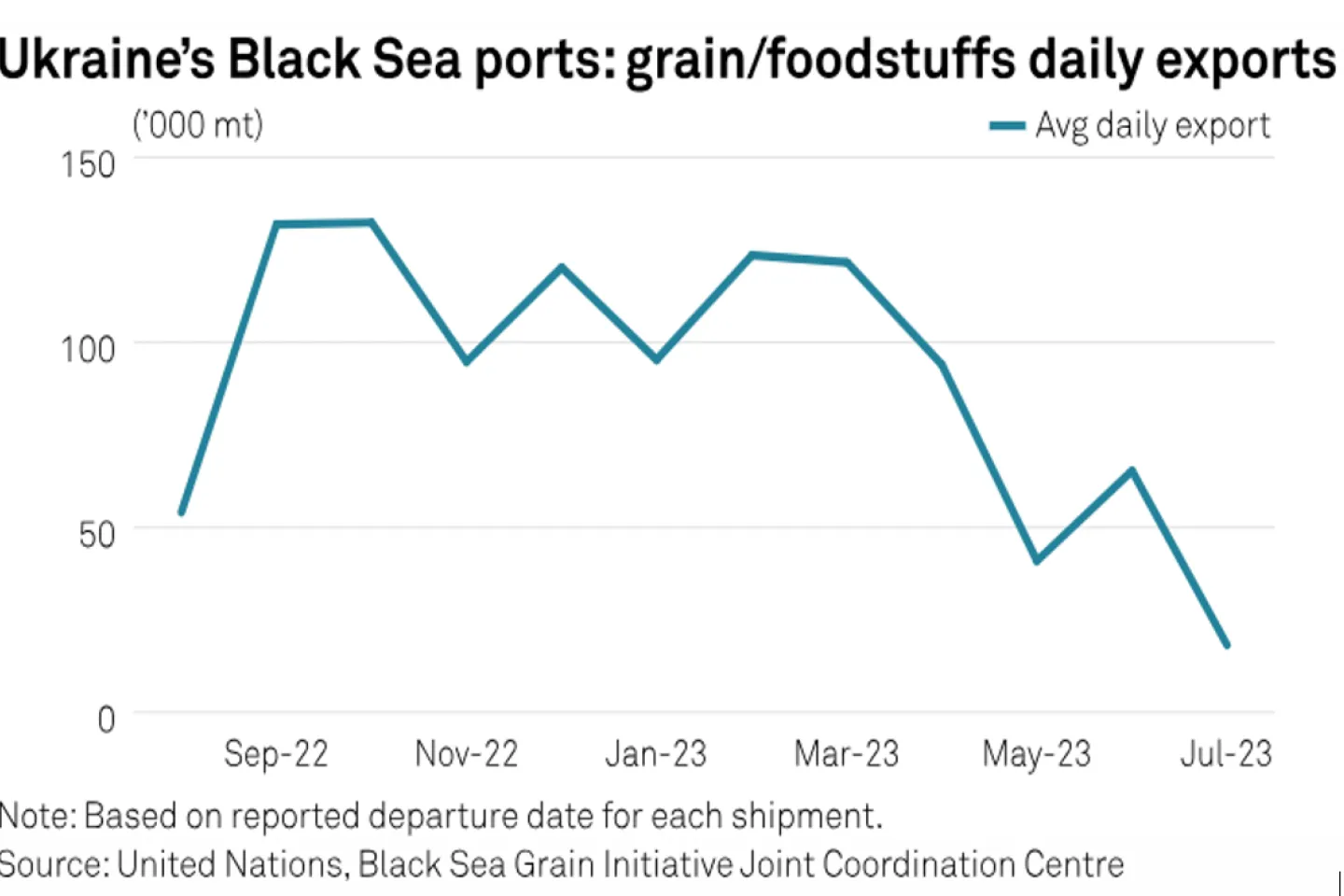

Ukraine's three Black Sea ports covered by the agreement shipped more than 20 million mt between October and March, but that flow slowed to a trickle. In the first 10 days of July, it was just 215,000 mt, UN data showed. The slowdown was due to the requirements of the UN-brokered agreement, which stated that every ship had to be inspected before and after it left Ukraine.

The inspection teams included representatives from all the signatories, and Ukraine said Russia's delegates deliberately limited the number of inspections conducted per day.

In March, the inspection teams were checking an average of six ships a day, but by June that had fallen to just two a day, according to the UN. Ukraine's Ministry for Restoration said this was because Russia has refused to register and inspect incoming ships. Average daily exports fell from 124,000 mt in February to 41,000 mt in May. Russia's Ministry of Foreign Affairs did not respond to a request for comment from S&P Global Commodity Insights.

Impatience with Russia's tactics has prompted some traders to call for more radical solutions.

"Our military would need to come up with a plan which does not include goodwill from the Russians," one of them said. "It is long due. ... I think something should be in the works," they added, echoing widespread hope among many of those whose grain export businesses were built around elevators and silos in the Black Sea ports.

Ukrainian President Volodymyr Zelensky said on 18 July that he had written to the UN and Turkey "with a proposal to continue the Black Sea Grain Initiative in a trilateral format – as it is best." The original agreement laid the foundations for insurers to provide cover for ships visiting Ukraine's Black Sea ports. In the absence of a Russian pledge of protection, it could be hard to find cover.

Ukraine's export routes

Ukraine was the world's fourth-largest corn exporter and fifth-largest wheat exporter in marketing year 2021-22 (July to June), with 27 million mt and 19 million mt, respectively. In MY 2023-24, S&P Global expects Ukraine to export 10 million mt of wheat, currently mid-harvest, and 19.5 million mt of corn, which is harvested in autumn.

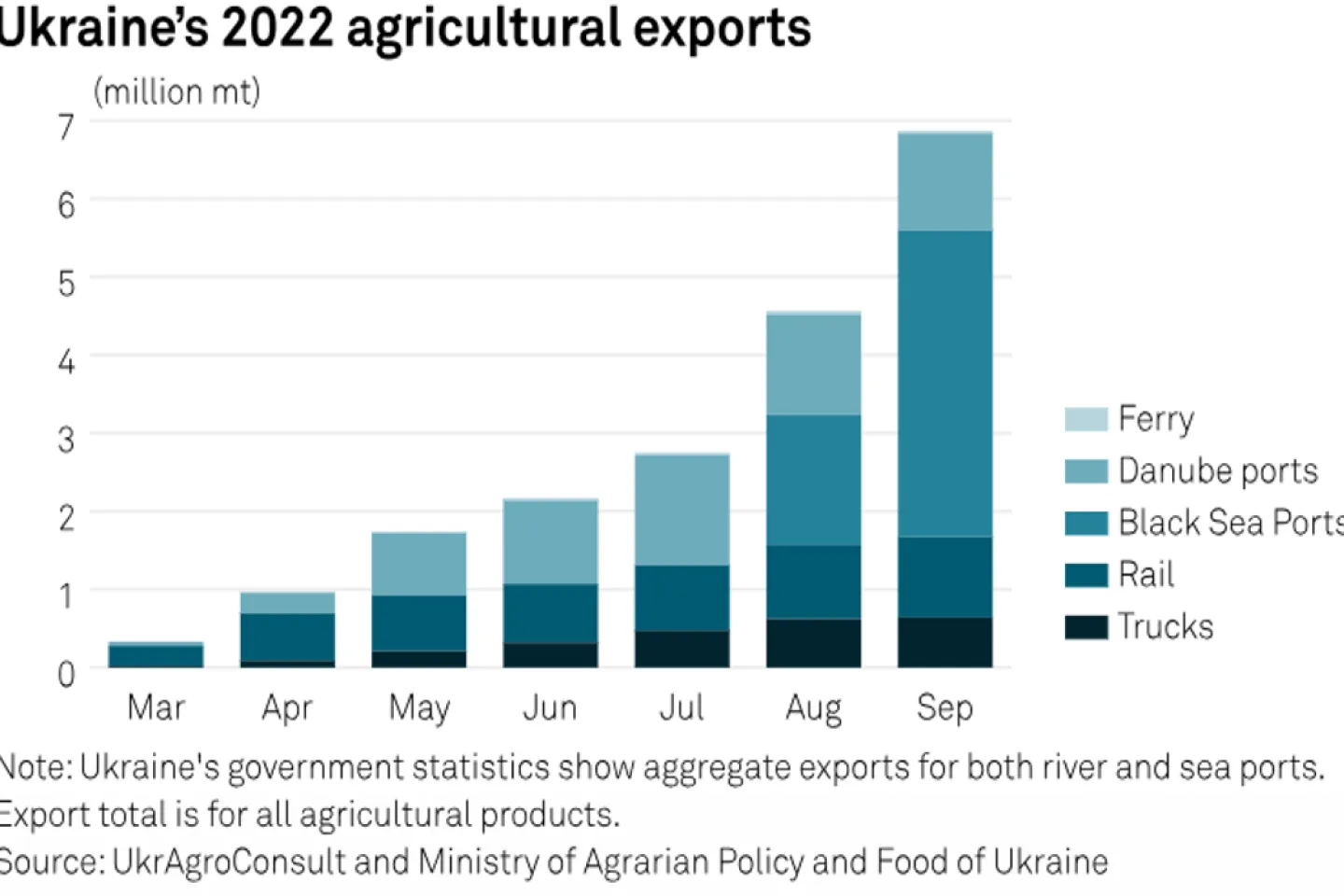

The crop cycle means that the demand on Ukraine's grain infrastructure is typically highest from August to December. In the two years prior to Russia's invasion, Ukraine exported more than 6 million mt/month for most of that that period.

The Ukrainian Grain Association estimates that at the time of Russia's invasion, Ukraine had around 1,200 inland silos providing storage capacity of around 66 million mt of grains.

The vast majority of that was exported through one of the three Black Sea ports or through Mykolaiv, a nearby river port that was excluded from the Black Sea Grain Initiative due to its proximity to the front line. Ukraine's ports have storage capacity of around 6 million mt, but almost all of that is at the Black Sea ports and Mykolaiv. Those four ports had a maximum potential capacity of 715,000 mt a day, whereas in 2022 the trucks, rail and barges couldn't handle more than 100,000 mt a day.

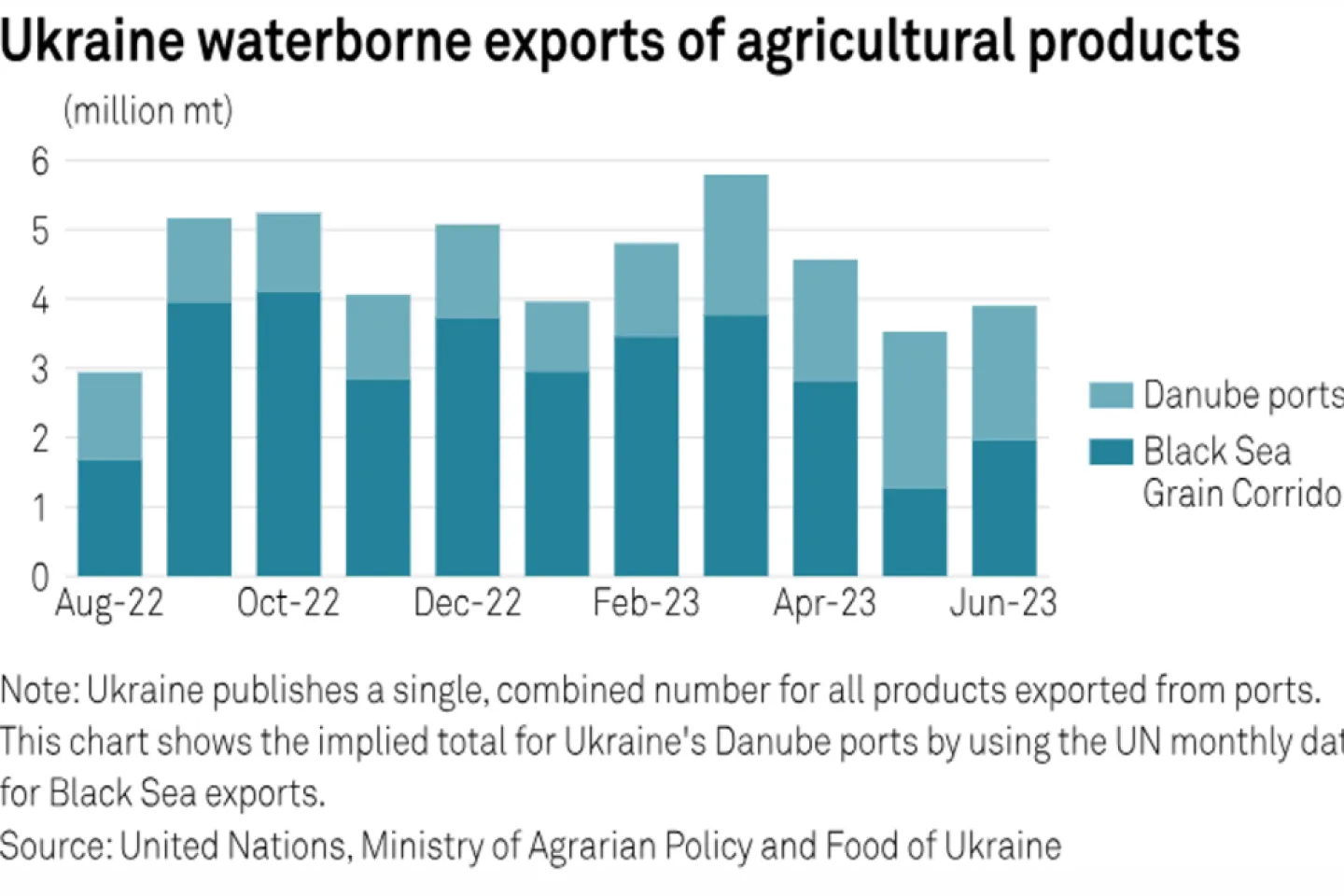

As the mechanisms of the Black Sea grain agreement have failed, exporters have turned to ports on the Danube. With the wheat harvest coming in, farmers in the Odesa region are sending their grain to the river ports of Reni and Izmail, rather than Odesa, a broker said, adding that they had seen a queue of 1,000 trucks heading in that direction.

This reverse flow represents a contortion of Ukraine's logistics, which evolved to support export hubs on the Black Sea. Exports from the Danube ports of Reni and Izmail were below 500,000 mt a month in 2021, but exporters are now hoping to boost that to 2 million mt.

There were around 30 berths in Izmail, according to one trader, who estimated the same quantity in Reni as well as around 10 in the port of Kiliya, which is farther downstream. In theory, that would mean that 70 coasters of barges could be loading simultaneously at Ukraine's Danube ports, but there are limitations due to the availability of pilots and tugs.

One company looking to the Danube is Kernel Holding, one of Ukraine's largest agribusiness holdings, with terminals in the Black Sea port of Chernomorsk that handled some 8 million mt in 2021.

Kernel is losing $5 million a month as a result of the dysfunction of the Black Sea Grain Initiative, the company's CEO told Bloomberg on 7 July. Ievgen Osypov said Kernel had already lost $57 million and is now using alternative routes. In February, it bought a terminal at the port of Reni.

"The acquisition is part of Kernel's strategy to secure backup options in case the Black Sea ports become inaccessible as a result of the termination of the grain deal," Kernel wrote in its first quarter financial report.

Kernel's investment was backed by USAID, which said in March that Kernel and two other agriholdings companies, Nibulon and Grain Alliance, were making combined investments of $44 million. This would be used to renovate berths at Reni, expand Izmail and acquire a transshipment storage facility in Slovakia.

Nibulon's assets are concentrated in Mykolaiv, the only one of Ukraine's Black Sea ports that wasn't reopened as part of the Black Sea grain deal. The company has spent some $16 million on three loading ports in Izmail with a daily loading capacity of 9,000 mt.

Kernel, Nibulon and the other operators on the Danube have a choice of where to take their grain: they can either load coasters and take parcels of 3,000 mt–12,000 mt direct to customers – mainly in the Eastern Mediterranean – or they can load a series of 1,500 mt barges and take the grain to the Romanian port of Constanta. From there, they can put the grain onto bigger ships for more economical voyages.

The flow of Ukrainian grain down the Danube will put Ukraine's famers in direct competition with Romanians for the use of the 10 available elevators in Constanta, where it costs around $10/mt to unload the grain from a barge into a silo and then transfer it back onto a bigger boat. Some Ukrainian exporters instead opt to bypass the terminals and transfer the grain directly in the port from barges onto Handysize and Panamax ships.

Constanta had surplus capacity before it became a hub for Ukrainian grain, but the country's exemption from EU import tariffs became a sensitive political topic in Bulgaria, Hungary, Poland, Romania and Slovakia, and the countries introduced a ban on imports from 2 May until 15 Sept. The ban still allows onward transit to other member states, and one trader said demand for rail wagons was strong in Italy.

Market conditions shift

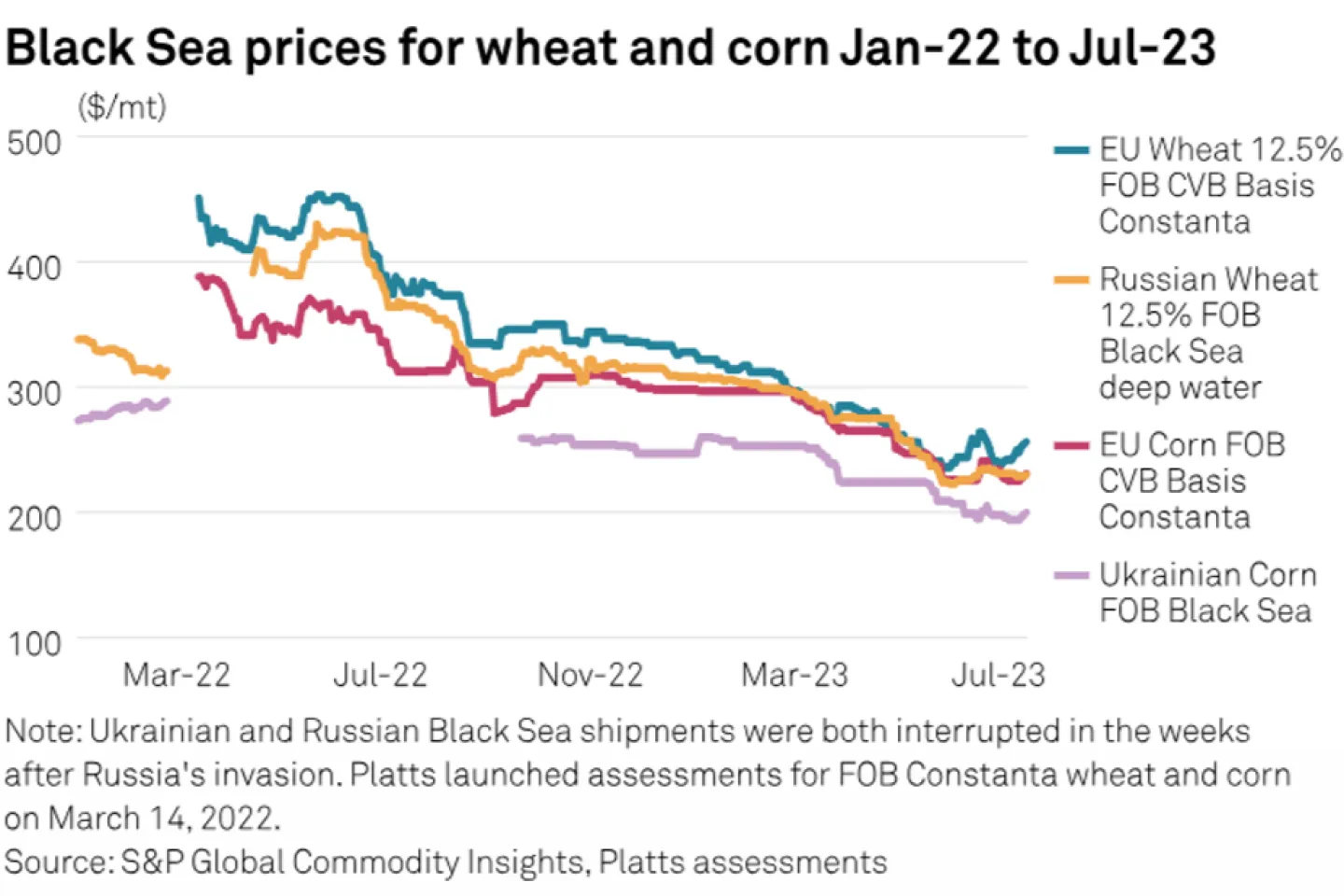

In hindsight, the Black Sea Grain Initiative was remarkable: at the same time as Russia was firing missiles at Ukraine's infrastructure, it allowed the country to regain the main route for exports or agricultural commodities, which in the prewar economy represented some 40% of all exports. Whatever Russia's motives, the global pressure for a deal was overwhelming in summer 2022 as the agreement was being negotiated – wheat and corn prices had been at multiyear highs.

On 17 July, Platts assessed 12.5% protein Russian wheat at $229/mt for a 25,000 mt parcel to be shipped from Novorossiisk in the second half of August. That compares with a price of $451/mt on 13 March 2022 for wheat from the Romanian port of Constanta, when the EU was seen as the only reliable source in the Black Sea. The fall in corn prices has been similar.

Ukraine may have balked at the idea that it owes Russia anything, especially the facilitation of ammonia exports from a Ukrainian port. Russia may have inserted terms that it knew Ukraine could never satisfy. Neither side met its formal obligations. United Nations Secretary-General Antonio Guterres described Russia's decision "as a blow to people in need everywhere."

Despite Guterres' appeal, the market impetus for a grain deal between Russia and Ukraine is now far weaker than a year ago. Silos in Brazil are overflowing as the country harvests a record corn crop, and global prices are now lower than they were prior to Russia's invasion of Ukraine. Black Sea wheat prices are also at their lowest levels since 2020, after Russia's bumper wheat crop in 2022 boosted stocks. Meanwhile, Ukraine's grain exporters and their government are developing alternatives that don't require Russia's consent.

Written by William Bland, S&P Commodity insights